are union dues tax deductible in 2020

For tax years 2018 through 2025 union dues and all employee expenses are. The amount of union dues that you can claim is shown in box 44 of your T4 slips or on your receipts and includes any GSTHST you paid.

How To File Your Taxes And Tax Tips For Part Time Workers

This publication explains that you can no longer claim any.

. Union Dues Deduction no longer available. A 2020 Center for American Progress Action Fund brief stated This type of above-the-line deduction would allow union members to deduct the costs of earning their. Tax reform changed the rules of union due deductions.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that. Are union dues tax deductible 2020. Brigitte Richer 2020-087195.

2018-19 Student NEA Rebate Application. The states official tax instruction book confirms union dues can still be deducted from state taxes subject to itemizing and if your miscellaneous deductions exceed two percent of your. The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings.

June 3 2019 1127 AM. Im a union Ironworker Ill be filing single and have made 41000 will my tools welding hoods etc still be a deduction and will my union dues be a deduction as well. Per IRS Publication 529 Miscellaneous Deductions.

This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion. 2022-2023 Prorate Dues Table Educators. Under current federal law employee business expenses are generally not deductible.

Tax reform eliminated the deduction for union dues for tax years 2018-2025. Line 21200 was line 212 before tax year 2019. As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union.

Deduction for excess premium. If you are an employee you can claim your union dues as a job-related expense if you itemize deductions. On certain bonds such as bonds that pay a variable rate of interest or that provide for an interest-free period the amount of bond premium allocable to a.

California along with other states including Pennsylvania and New York already allows union members to lower their taxable income by the amount of their union dues through. Job-related expenses arent fully deductible as. The NLRA allows unions and employers to enter into.

That is the deductibility has been suspended for tax years 2018 through 2025. Tax Deduction of Your TALB Dues. Ohios 2019-2020 Updated Ethnic Minority Plan.

The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and expenses for. You can claim a tax deduction for. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your.

A reminder for tax season. Deduction of union dues. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union.

A Hidden Trap In Charitable Deduction For Nonitemizers

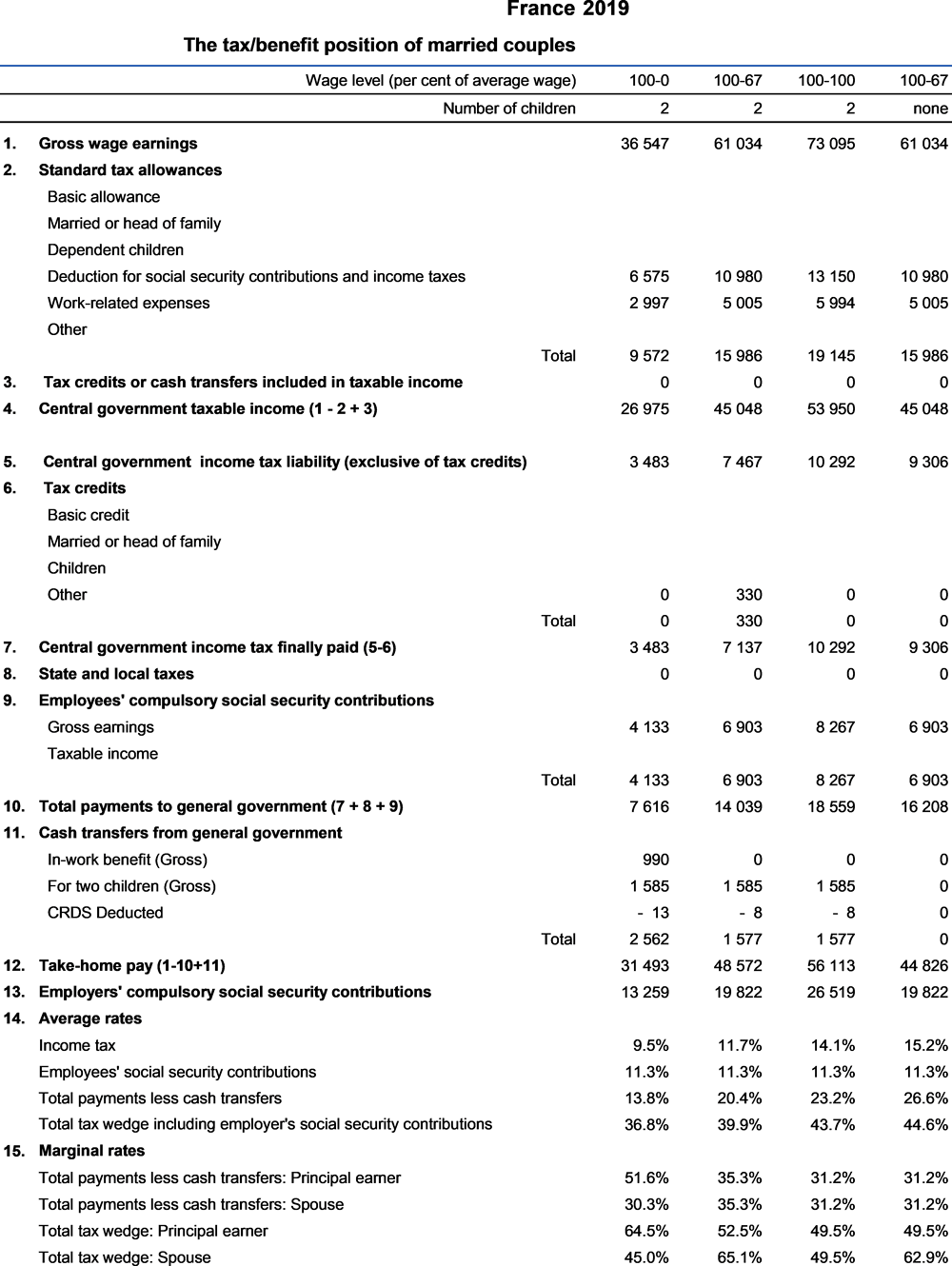

France Taxing Wages 2020 Oecd Ilibrary

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

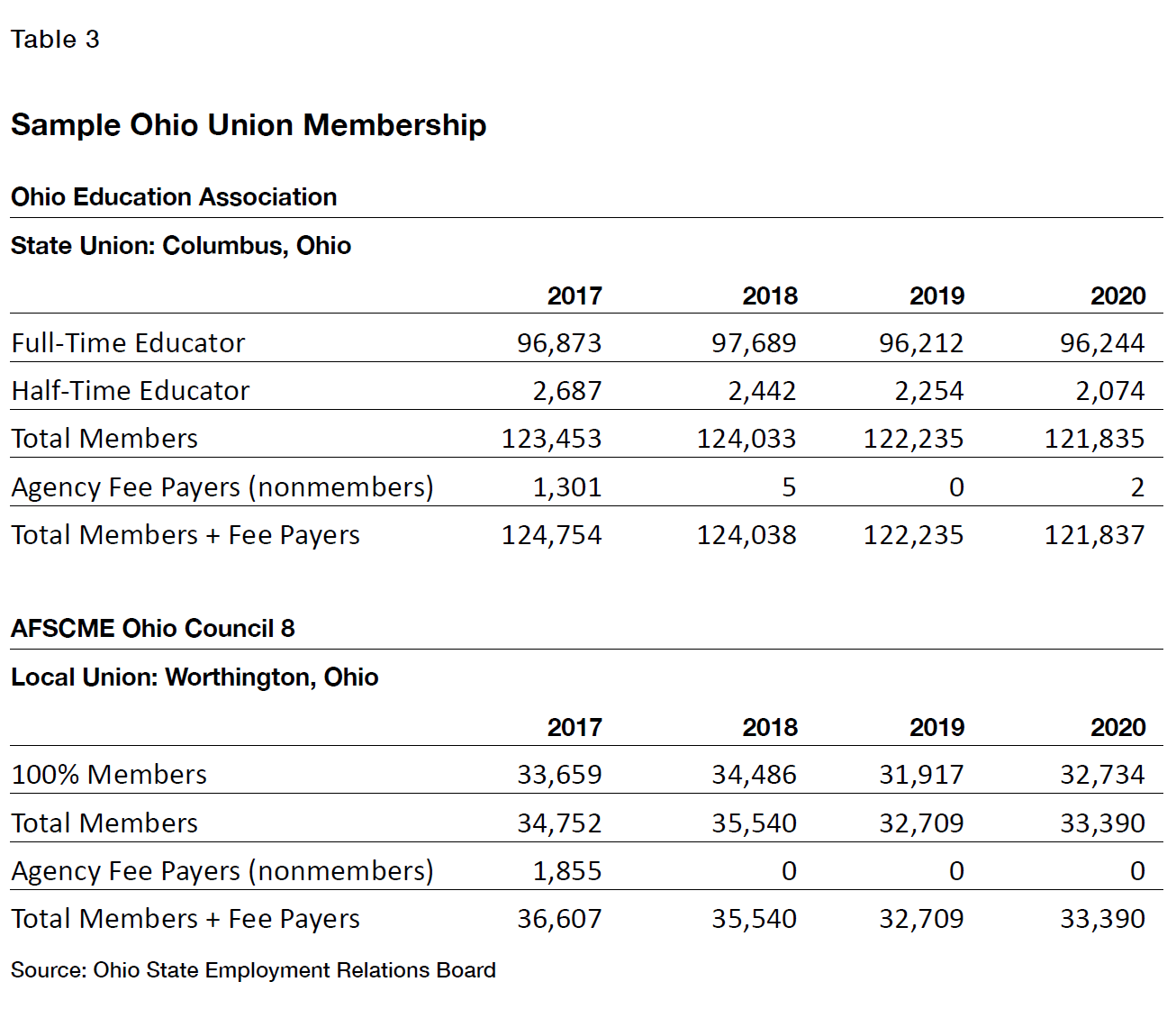

By The Numbers Public Unions Money And Members Since Janus V Afscme Manhattan Institute

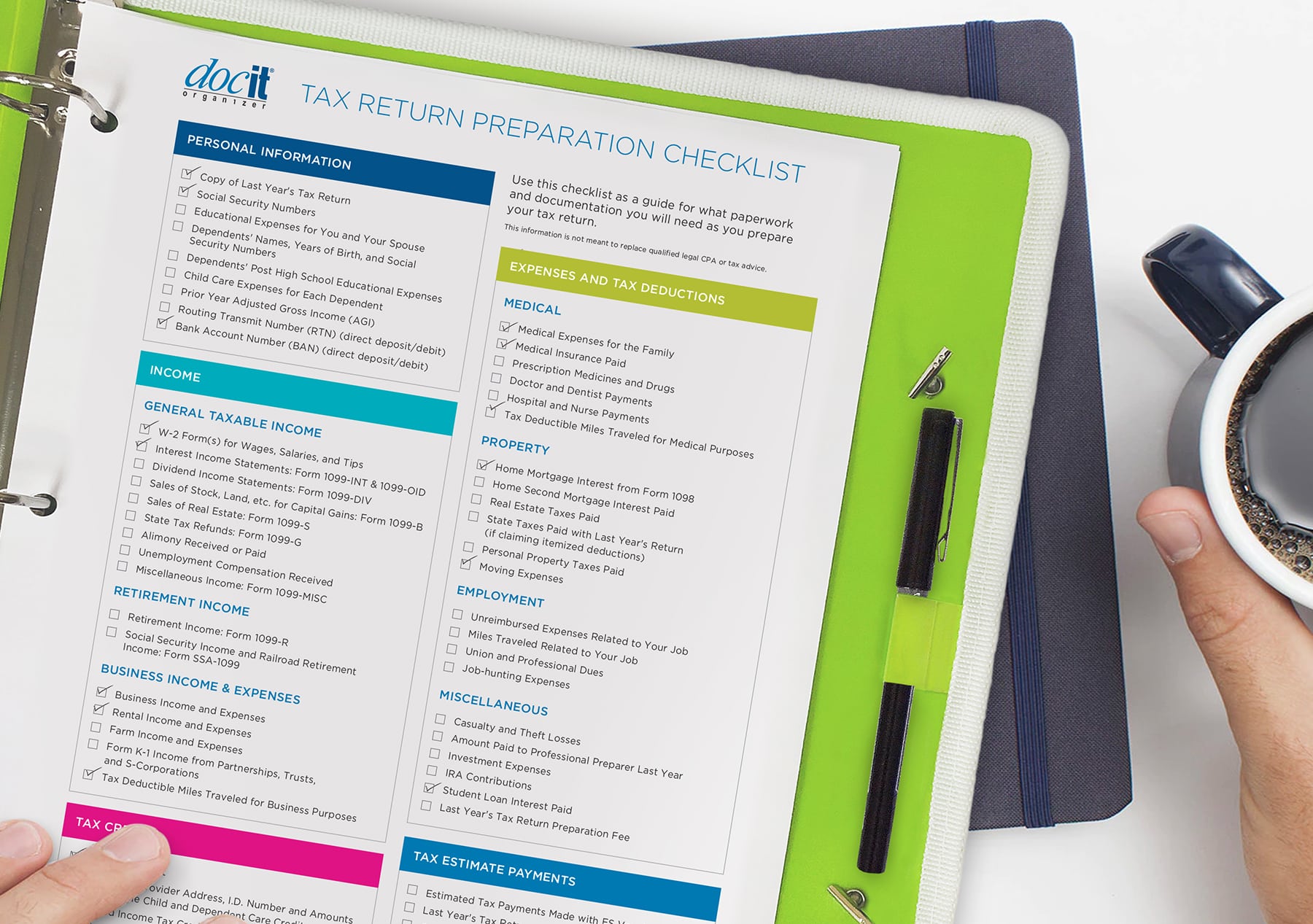

Docit Tax Return Prep Checklist Paris Corporation

/tax-deductions-2000-118868c29f694b2292eda47529a10a89.jpg)

Commonly Overlooked Tax Deductions

Tax Preparers Warn Your Refund May Be Smaller Than Usual This Year Here S Why Los Angeles Times

What Tax Deductions Can Teachers Take Write Off List Tips

Deducting Union Dues On Nys Taxes Uup Buffalo Center

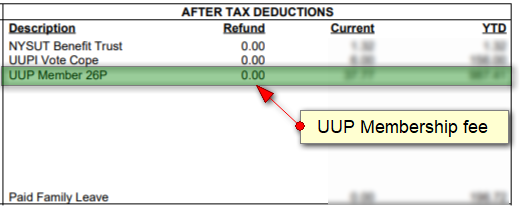

What Are Payroll Deductions Article

Please Calculate The Employer S Crapayroll Expense For The Paycheque Course Hero

Different Types Of Payroll Deductions Gusto

Can You Deduct Union Dues From Federal Taxes

Tax Time Remember These Deductions Your Union Won For You

Why All Workers Should Be Able To Deduct Union Dues Center For American Progress