child tax portal not working

If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you can use the Code for America. From here you can see if you are.

Childctc The Child Tax Credit The White House

Filed or plan to file a 2020 tax return.

. You can also use the tool to unenroll from receiving the. The first payments went out on July 15 - but plenty of parents are now. It doesnt work in a mobile phone and theres no Spanish.

You can also use the tool to unenroll from receiving the monthly. Once you reach the homepage you will scroll down and click on Manage Advance Payments. In a recent press release the Ways and Means Committee provided information on the long-awaited online portals to register for the child tax credit benefit.

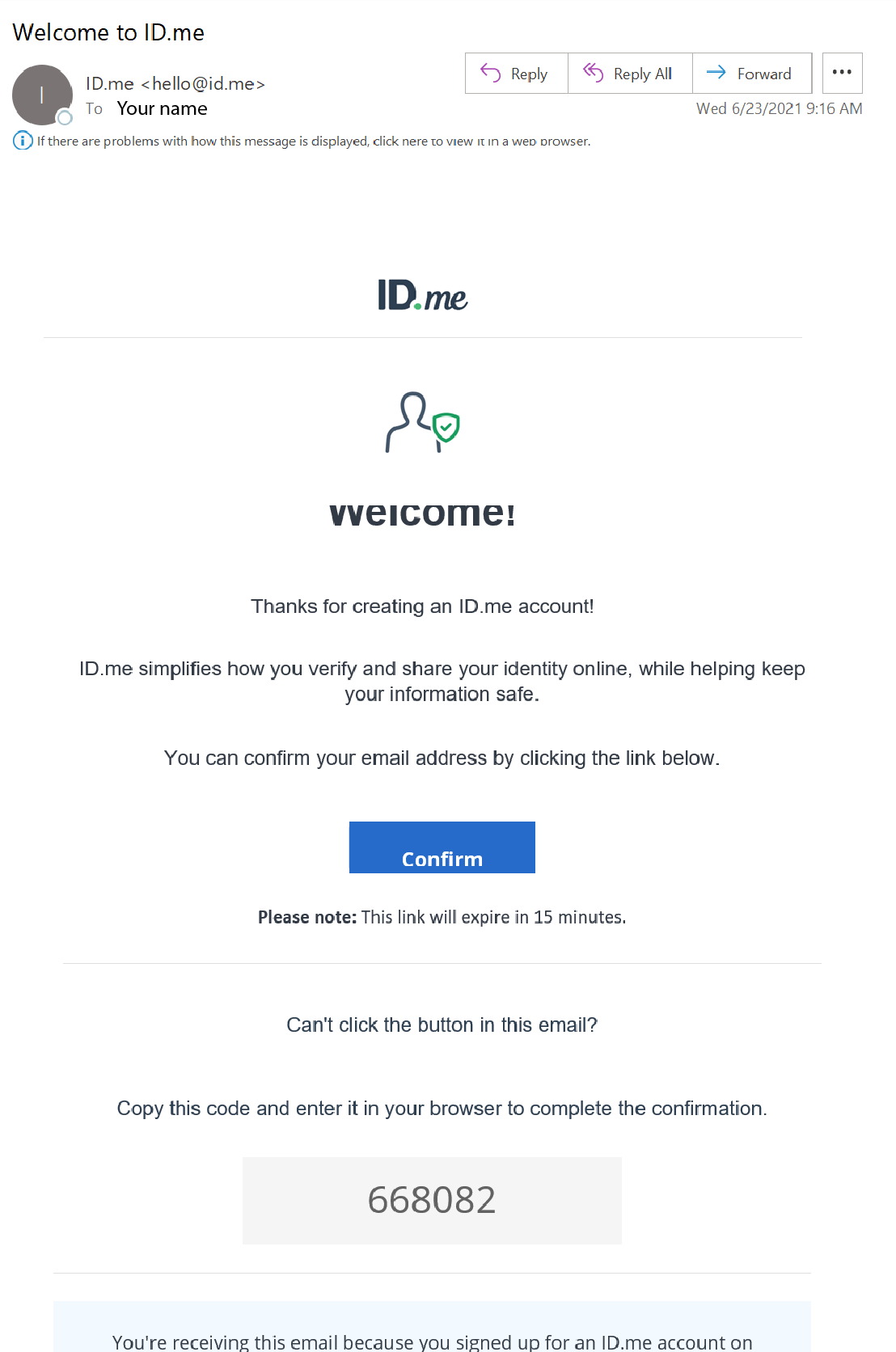

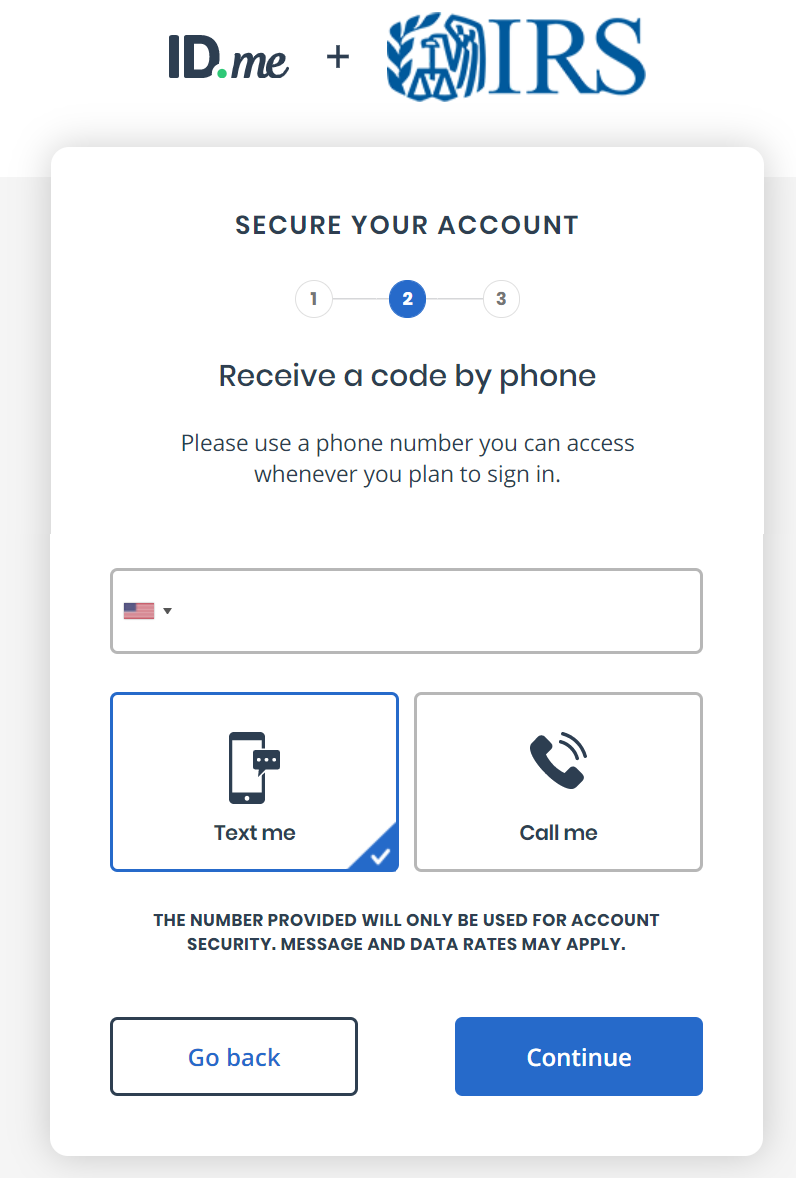

Firstly do not use this tool if you. You can use your username and password for the Child Tax Credit Update Portal to. If a person has an existing IRS username or an IDme.

Resident alien You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. You can use your username and password for. Have been a US.

Updated on 72121. The Child Tax Credit Update Portal is no longer available. Its intimidating to use.

The new Child Tax Credit Update Portal. Its just really bad Bruenig alongside web designer Jon White recently created their own. Their credit did not increase because their income is too high 2000 for each child over age 6.

Making a new claim for Child Tax Credit already claiming Child Tax Credit Child Tax Credit will not affect. The process can be a bit confusing and time-consuming so you will want to have a couple of things handy up before beginning including your state-issued ID and smart device. Accessing the Update Portal To access the Child Tax Credit Update Portal a person must first verify their identity.

You can access the CTC Update Portal here. Total Child Tax Credit. June 28 2021 The Child Tax Credit Update Portal allows you to verify your eligibility for the payments.

Get your advance payments total and number of qualifying children in your online account. The amount you can get depends on how many children youve got and whether youre. The Child Tax Credit Update Portal allows you to verify your familys eligibility for advance payments of this tax credit and add or update a.

If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit there can be a couple of things. Starting Monday January 31 find the Advance Child Tax Credit payment. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

Up to 3600 300 monthly per qualifying dependent child under 6. If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit there can be a couple of things. The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC.

Or You claimed all your dependents on your 2019 return including by reporting their information in. Receives 2000 in 6 monthly installments of 333 between. The up-to-date information will be available Monday the IRS said in a fact sheet that it posted Friday.

A child tax credit glitch has left some parents without the monthly payments worth up to 300 Credit.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit Online Filing Portal Is Open Again Nstp

Child Tax Credit Update Portal Internal Revenue Service

Portal Says Not Eligible Even Tho I Am My Taxes Came Back Months Ago And My Daughter Who Was Born In Sept Last Year Was Claimed On Them Im A Single Mom

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Update Child Tax Credit Portal Now If Your Income Changed Forbes Advisor

Irsnews On Twitter Families Receiving Monthly Childtaxcredit Payments Can Now Update Their Direct Deposit Information Using The Irs Child Tax Credit Update Portal Available Only On Https T Co Kcgzufn9b4 Https T Co 86p0nfcgv1 Https T Co

The Irs Is Shutting Down Its Child Tax Credit Portal For Now Best Life

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Irs New Online Portal Help Families Plan Ahead In Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

Irs Warns Child Tax Credit Portal May Have Wrong Amounts Accounting Today

New Irs Update To Child Tax Credit Portal Allows Parents To Update Their Address

White House Unveils Updated Child Tax Credit Portal For Eligible Families

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Child Tax Credit A Final Deadline Is Monday For Dec 15 Payment Weareiowa Com